On this page

The Parish Giving Scheme (PGS) manages regular Direct Debit and one-off giving, designed to support churches to fund their mission and ministry. It reduces the burden of work on church volunteers and provides a simple and secure service to givers.

The service is freely available to all parishes, their churches and donors.

How it works

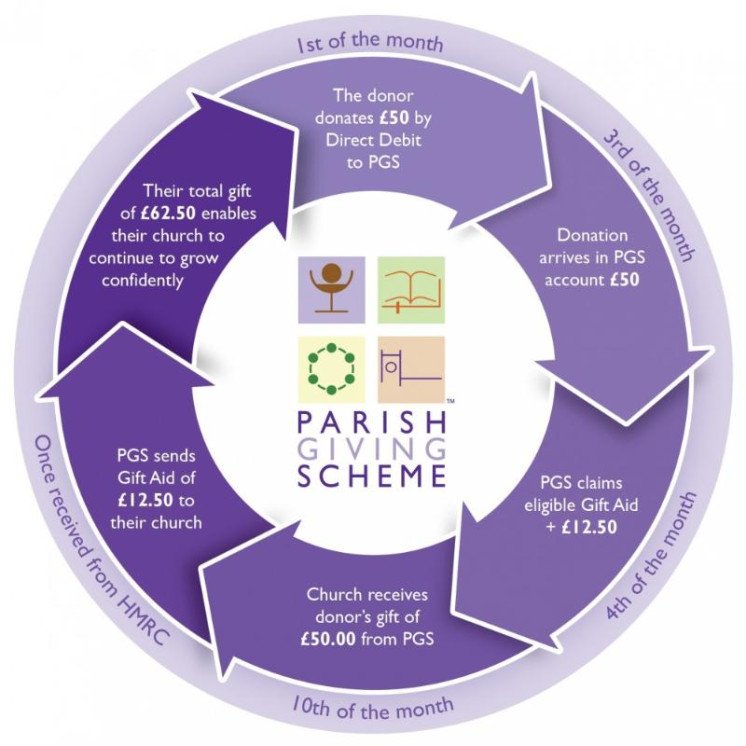

Givers can set up a Direct Debit with PGS online, over the phone or by filling in a paper gift form at church. This can be made on a monthly, quarterly or annual basis. Each gift is restricted to a parish church chosen by the giver and cannot be used elsewhere. The gift will be passed back to the church by 10th of the month. Any eligible Gift Aid will be sent separately once it has been received from HMRC.

A unique feature of the scheme is the option for the giver to commit in principle to increase their gift annually in line with inflation. This is entirely at the giver's discretion on an opt-in basis, but it is proving popular - with more than 55% of the donations received currently index-linked.

Direct Debit Guarantee Scheme

The Direct Debit Guarantee Scheme protects gifts and is easy to set up and manage. All the PCC needs to do is pass a resolution to start the Scheme and show leadership by joining and encouraging others to join. The scheme is free to churches and the Parish Giving Scheme does all the work.

How is Gift Aid claimed?

The gift is claimed through the Parish Giving Scheme and will be passed back to the parishes bank account by the 10th of the month. Any eligible Gift Aid will be sent separately once PGS has received it from HMRC (this usually takes 5–8 working days).

PGS is a charity and therefore the Gift Aid declaration is made to, and held by, the charity. If HMRC audits a church, they will audit PGS for all its PGS gifts to that church. However, you will still have to claim Gift Aid for any other gifts received directly by your parish.

If one of your givers becomes eligible to claim Gift Aid after starting their gift through the Parish Giving Scheme, they must complete a PGS Gift Aid Declaration.

Key benefits

The individual benefits from:

- Retaining control of how much they give, how often and to which church

- Using a simple giving method that provides regular financial support to their church

- The option to increase giving annually to protect their gift against inflation

- Anonymity, if preferred

- Peace of mind that the Direct Debit Guarantee Scheme protects their gifts

Givers can choose to give regularly online, by phone or by post (using the PDF gift form available from your Parish Giving Advisor) or make one-off gifts via the PGS website.

The treasurer benefits from:

- Reduced administration and paperwork

- Easy access to monthly and annual (both tax and calendar year) statements

- Saving time; for themselves and those who count the money from plate collections

The church benefits from:

- Stable and often increased planned giving, by launching PGS alongside a Giving Review

- Efficient and regular reclaim of Gift Aid, improving cashflow

- Protection against static giving, by offering givers the option to inflation-link their gift

"Joining the PGS has meant that we now receive a considerable amount of our Gift Aid reclaim promptly every month, helping our cash flow, which together with annual increases in donations has been much appreciated. It has also meant a reduction in workload for our treasurer and myself."

Tim Pearce, Planned Giving and Gift Aid - All Saints’ Church, Springfield, Chelmsford.

Registration process

Parish Giving Advisors Beccy Hills and Michelle Cottis are here to advise you on the Parish Giving Scheme, guide you through the registration process and support you to launch the scheme in your parish. They can be contacted via pgs@chelmsford.anglican.org.

Registering your parish for PGS is a simple process following the steps below:

- Read the information about the Parish Giving Scheme on this web page. You can also find out more on the PGS website

- Discuss with your PCC and gain PCC approval to use the scheme. You may find the PCC frequently asked questions document helpful

- Email pgs@chelmsford.anglican.org to request a registration form

- Complete the registration form. Leave the Church Code section blank; this will be completed by us

- Email pgs@chelmsford.anglican.org with the completed form and a copy of a paying in slip for the PCC bank account

- The form will be checked and sent to PGS for processing

- The Statement Receiver will receive a confirmation email when the registration is complete. This usually takes 1-2 weeks

You are now ready to start accepting donations.

Contact pgs@chelmsford.anglican.org if you have any questions at any stage of the process. Our Parish Giving Advisors are here to support you.

Resources and downloads

Explainer video

You can explain PGS to your church using the video below:

Contact details

If you have any questions about the Parish Giving Scheme please contact our Parish Giving Advisors Beccy Hills and Michelle Cottis by email: pgs@chelmsford.anglican.org